Discover how you happen to be able to get mortgage help through Georgia’s COVID resident-save program.

In early 2021, President Joe Biden signed the latest Western Save yourself Plan Work with the laws. Which law authored a homeowner Guidelines Financing, a national program, to give $ten mil toward says to aid domiciles which can be trailing on the mortgage loans or any other houses expenditures due to COVID-19.

Qualified homeowners for the Georgia that experienced a financial hardship on account of COVID-19 may a few of the as much as $354 mil used on the official-doing $50,000 for each domestic-through the use of towards the Georgia Mortgage Guidelines system. This method uses government money to aid home owners create mortgage payments and you can spend almost every other house-associated costs.

Offered Financial help having Georgia Home owners

- You might be in a position to qualify for funds to help you reinstate the outstanding home mortgage. You might like to meet the requirements to acquire up to around three days of additional mortgage repayments for many who have not but really recovered economically.

- You will be eligible a-one-go out commission with the lender to attenuate the complete mortgage balance (a principal curtailment).

- You could possibly receives a commission to blow delinquent non-escrowedproperty taxation, homeowners’ insurance rates, condominium otherwise homeowners’ connection costs, and you will electricity costs.

Even though a foreclosure has started, you might still have enough time discover help from the newest Georgia Home loan Guidance program. Alert the loan servicer which you have put on the application form. However, you should know one making an application for recommendations will most likely not end an effective foreclosure. After you use, alert the program administrator towards foreclosures and gives a copy of one’s file indicating you to a foreclosures income could have been arranged for your house which means your app is going to be quick-monitored.

You might like to have time to work through a substitute for property foreclosure loans Woodstock along with your loan servicer. And in case you have got questions about the fresh new property foreclosure process inside the Georgia or should learn about potential defenses to help you a property foreclosure, envision conversing with a foreclosures attorney.

Eligibility Standards on Georgia Mortgage Advice Program

So you can be eligible for respite from this choice, you really need to have sustained a monetaray hardship (a material reduced income otherwise a boost in bills) once , due to COVID-19. If your pecuniary hardship try cured with an alternate offer otherwise sorts of recommendations, you aren’t eligible.

- Your house must be based in Georgia.

- You need to be already living in your house since your number one residence, therefore must have been living in the home at time of the difficulty. (Second belongings, funding characteristics, and you may vacant services you should never qualify. Are available mortgage brokers, however, meet the criteria.)

- Our home needs to be titled regarding the term off a beneficial sheer individual, maybe not a keen LLC, faith, or business.

- When you yourself have a mortgage, it will have been a compliant mortgage at the origination.

- Your family members income need to be equivalent to otherwise less than 100% of area median earnings (AMI) for your state. Otherwise family earnings need to be comparable to otherwise below 150% of one’s county’s AMI for those who (the fresh new resident), debtor, or mate is known as a socially disadvantaged individual, like those that have been the newest victim off racial or cultural bias or social prejudice, or individuals with restricted English competence, eg.

Resident direction applications and needs change commonly, and never all the lenders and servicers engage. Be sure to browse the official Georgia Mortgage Guidance web site for the newest advice and eligibility criteria.

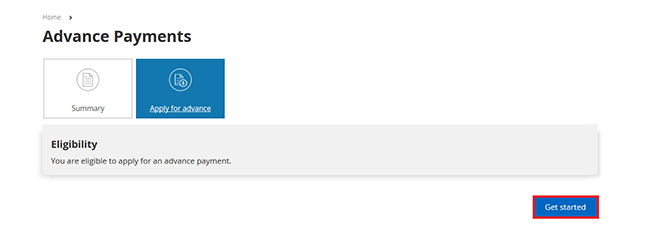

Tips Sign up for Help from the fresh Georgia Home loan Recommendations System

Check out the Georgia Mortgage Guidelines web site to get assist from this system. You will have to bring some documents along with your software, such financial comments or statements for your almost every other construction-relevant will cost you, proof money (for example shell out stubs and you will tax returns), and you will a government-awarded ID (such as a driver’s license).

What is the Due date to apply straight to the Georgia Mortgage Recommendations System?

The program will continue up until the before regarding , or when the loans allotted to the application has started sick. If you think you could be considered, you need to incorporate as quickly as possible.

Prevent Homeowner Guidance Fund Cons

When you get an unwanted bring by the phone, in the You.S. post, courtesy email, otherwise of the text message giving home loan relief otherwise foreclosures help save functions, be wary. Fraudsters sometimes address residents having trouble with regards to homes repayments.

The newest Georgia Mortgage Guidelines program is free. If the individuals requires you to definitely pay a charge to locate homes guidance or even to found foreclosure protection qualities out of this system, it is a scam. Make sure you statement people instances of scam.

Find out about the brand new Georgia Home loan Guidelines System

When you yourself have issues otherwise need assistance together with your software, call 770-806-2100, 877-519-4443, email , or remark the newest Georgia Mortgage Guidelines program Faqs.

Also, thought getting in touch with a HUD-approved property specialist who can work with you free of charge. To obtain a counselor near you, go to HUD’s webpages or label 800-569-4287.