This season, rate of interest fashion 2024 recommend rates may go up. Positives believe it is because rising cost of living and monetary changes. Borrowers need to keep a record of this type of manner. Getting advised helps borrowers bundle the money greatest.

Figuring Your home Collateral Mortgage

Learning how to figure out your property security mortgage might help you make smart-money choices. Equipment such as the wells fargo home security online calculator allow easy. It let people see how far they are able to borrow by searching within their house’s really worth together with financial leftover to expend.

The latest wells fargo family guarantee online calculator is a great product to have home owners. It helps you work out how far you could potentially obtain. Here is how first off:

- Get into your current home really worth.

- Input the an excellent mortgage balance.

- Promote information regarding various other liens otherwise fund to your property.

- Review new estimated amount borrowed brand new calculator ways centered on their enters.

This easy processes shows as to why you should learn their house’s collateral. It can help you have made the most from the loan prospective.

How to Assess The Home’s Guarantee

- Perform a comparative sector research observe exactly what equivalent residential property is value.

- Hire a professional appraisal services to have a detailed look at your residence’s worthy of.

- Explore on the web valuation units, however, think of they may not be direct.

These processes are great for finding out your property security. They give a clear image of just how much you could borrow secured on your property.

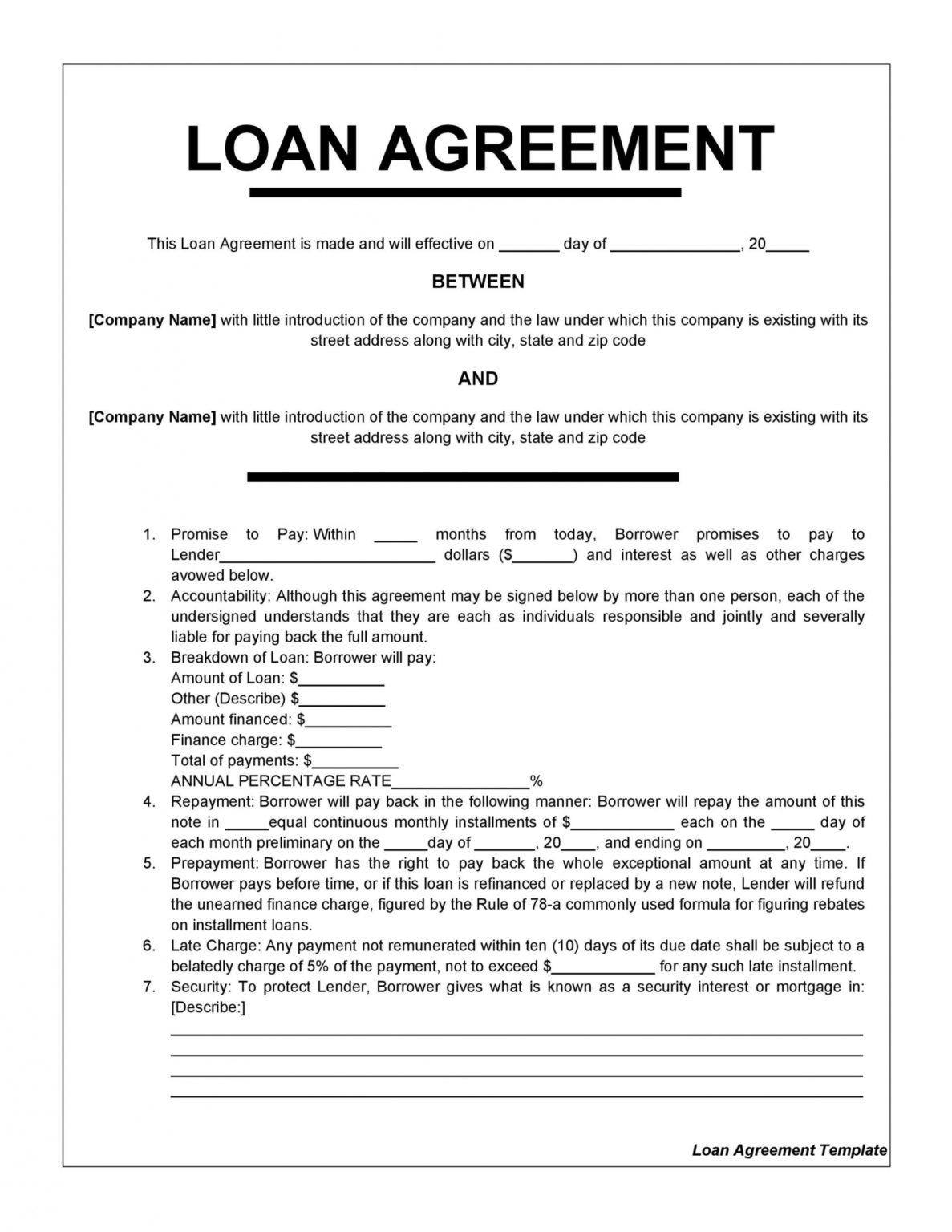

A streamlined, modern calculator toward Wells Fargo logo prominently presented during the best. The new calculator displays a money number inside committed font, symbolizing the home guarantee amount borrowed. The newest keypad have higher, easy-to-push keys and you can boasts amounts, quantitative factors, and you can earliest mathematics symbols. The back ground is a great gradient out of chill organization and you can veggies, providing the picture a professional and you can financial become.

Qualifications having a beneficial Wells Fargo Home Collateral Mortgage

It’s important to understand what you want to possess an effective Wells Fargo house security mortgage. We’re going to glance at the trick things should have, particularly a good credit score and you can proof of earnings. Providing these things ready can help you score a loan that have ideal terms and conditions.

Called for Credit rating to possess Approval

You desire a credit rating between an excellent and you will advanced locate accepted. A get more than 700 is the better, giving you much more loan choice and lower cost. Definitely check your credit history and you will boost any mistakes before applying to increase the possibility.

Earnings and you can A position Standards

Wells Fargo really wants to come across evidence of your earnings. You may want to exhibit pay stubs, W-dos versions, otherwise taxation statements. That have a steady work assists your application as well. A stable earnings is key for finding the loan and exactly how far you might obtain.

Wells Fargo Domestic Security Loan Criteria

It https://paydayloancolorado.net/mancos/ is very important know the wells fargo domestic equity loan conditions while contemplating this one. There are particular procedures and you may records you really need to ready yourself. This makes the procedure simpler and assists you have made ready to have what is actually 2nd.

- Proof money, including spend stubs or income characters

- Tax statements from the earlier two years

Which have all paperwork getting money in a position suggests you’re economically responsible. Knowing what you need can help you pertain successfully.

Application Techniques to have Wells Fargo Family Security Fund

Trying to get a good Wells Fargo family security loan is easy. It involves multiple tips that make the method effortless. Knowing what you should do helps you get ready well. Like that, you are able to the job solid as well as have the fresh money you need.