If you are not knowing whether or not 3rd Government ‘s the correct bank for your house equity demands, here are some the listing of domestic equity enterprises.

Step one are finding a lender towards proper situations, terms and conditions, and cost. 2nd, you will need to be sure that the lending company you decide on treats the consumers better and can leave you a positive feel.

Thus considering customer evaluations and you will reviews before you take aside a beneficial financing is essential. Remember: Will, consumers with advanced level otherwise average enjoy try not to discuss they on the web-however, evaluations helps you spot habits and you may pick possible concerns.

The greater Team Bureau (BBB) is one top place to browse. 3rd Government isnt a better business bureau-licensed bank however, keeps a the get on the agencies. Only eight consumers possess released critiques, and therefore mean a score of just one.5 away from 5 famous people. All of these speak about issues with the loan acceptance Tucson loans process.

Manage I be eligible for good HELOC or household equity loan regarding 3rd Federal?

Before you take away property guarantee financing otherwise line of credit out-of people bank, together with Third Federal, you ought to be sure you meet the requirements. Qualifications standards center to factors as well as your credit rating, credit history, earnings, debt-to-earnings ratio (DTI), and you may most recent domestic equity.

Third Federal will not reveal the credit rating or income standards. Overall, you need good credit so you’re able to qualify for a property security product and you can snag the best possible costs. Third Federal constraints individuals so you’re able to a combined LTV regarding 80%, so you could only sign up for to 80% of the home’s latest appraised well worth, without any left mortgage balance or any other liens from the property.

You must inhabit the areas where such loans and you can HELOCs are supplied. This can include twenty-six states for 3rd Government HELOCs and you can half dozen getting house collateral funds. Your home needs to be the majority of your household, and you need to take the home in order to be considered.

You can view rates centered on place and amount borrowed to your Third Federal’s web site. As prices it will make usually do not consider your credit score, earnings, otherwise DTI, they may transform when you use. Yet not, you can purchase a sense of and this tool provides the most useful value to you personally and you may meets your needs before applying, that will apply to your borrowing from the bank.

How to pertain that have Third Federal?

- Label

- Target

- Day regarding delivery

- Possessions address

- License count (You might have to upload a copy.)

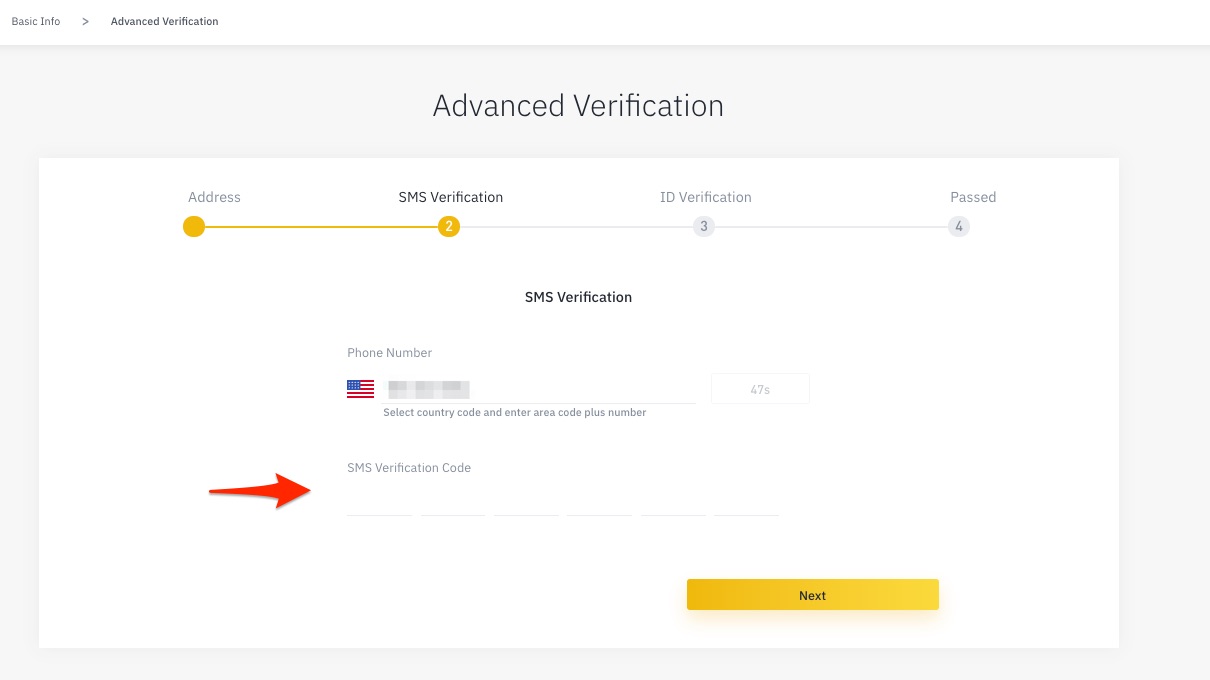

You can very first have to bring your own Personal Safety count and you may authorize Third Federal to get your credit score. The lending company will not promote prequalification having a soft credit score assessment.

Why does Third Federal regulate how far I could obtain?

Basic, you might only acquire inside Third Federal’s domestic collateral borrowing from the bank limits, ranging from $10,000 so you can $two hundred,000. (If you’re in a number of aspects of Florida or Kansas and are interested in brand new Fixer Higher Household Fix mortgage, you can purchase a smaller loan for $step one,000 in order to $9,900.)

Third Federal allows you to acquire doing a great CLTV out-of 80% on these limits. You could potentially pull out doing 80% of one’s house’s most recent worth without any existing funds otherwise liens into possessions.

Therefore if you reside really worth $three hundred,000, along with a mortgage equilibrium off $100,000, you might borrow up to $140,000 with a 3rd Government home collateral financing otherwise line of credit:

Beyond you to definitely, you’re next minimal in the way far you might acquire centered on individual things. Certain loan providers, including, may make it an inferior LTV getting borrowers having down fico scores otherwise increased DTI.