Pertains to England

It guide are signed up in terms of the new Discover Government License v3.0 except in which or even mentioned. To access so it licence, head to or build towards the Guidance Policy Team, New Federal Archives, Kew, London TW9 4DU, otherwise email:

Where i have understood any third party copyright laws pointers you will have to get consent throughout the copyright proprietors worried.

Trick recommendations

Consumers with this particular plan should provide defense in the form of an extra legal charges along the home purchased towards Assist buying collateral loan.

Level of loan

The maximum you could use out-of Help Buy in the The united kingdomt was ?120,000 or over in order to ?240,000 to have London area. There isn’t any lowest amount.

Customer deposit necessary

People should provide in initial deposit regarding at least 5% of your own full cost of the house bought below so it strategy

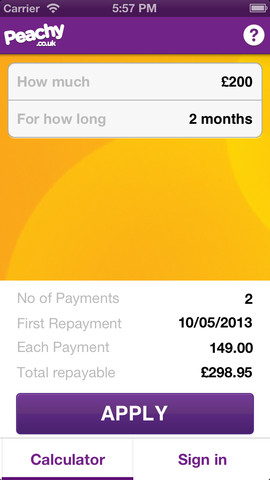

Volume, count and you may number of costs

After five years you are necessary to pay an appeal payment of just one.75% of your number of your Assist to Get shared equity mortgage during the time you purchased your property, ascending from year to year following of the boost (or no) on Merchandising Costs List (RPI) as well as 1%. Addiitional information are on page 18.

Most other payments and you may fees

You must pay a month-to-month management percentage regarding ?step one four weeks from the beginning of your own financing until it is paid off.

Total amount repayable

The total amount repayable from you could be the proportion off the market worth of your house which was funded from this loan, along with appeal and you may charge. The total amount you will have to pay back within the mortgage contract will depend on industry worth of your house once you pay back the assistance to invest in guarantee mortgage and the rates away from rising cost of living for the time being. An example is actually shown on the page 21 including the equivalent Annual percentage rate.

Assist to Buy helps make brand new build land accessible to most of the house customers (not only first time customers) who want to purchase an alternative household, but ple right down to deposit conditions however, exactly who you may if you don’t be expected to experience a home loan.

As much as a total of 20% within the England or more so you’re able to 40% into the London area [footnote 2] , of your price is present into the customer because of an enthusiastic security financing funded by Authorities as a result of Belongings England.

Help to Purchase is available in The united kingdomt out of home designers registered to offer the strategy. Help to Pick has been readily available since the 2013. Within the , Regulators revealed an extension of one’s step up to 2021 (this may romantic before in the event the every investment is removed up prior to 2021).

This article will bring an overview of the item. When you need to know more, or you have to pertain, excite speak to your Help to Pick agent .

Your residence is generally repossessed unless you keep pace payments with the a mortgage and other financial obligation secure involved.

Make sure that these types of mortgage loans can meet your circumstances if you like to go or sell your home or you require the ones you love to inherit it. If you’re in just about any question, seek independent recommendations.

Having Assist to Purchase, the customer (you’) expenditures another type of home with the an alternate build development that have guidelines of House The united kingdomt in the form of a guarantee financing.

For Help to Pick inside the England, maybe not London area, you should pull out an initial home loan (that have a being qualified loan company age.grams. a financial or strengthening people) for at least twenty-five% of the value of the property you want to get. loans Stamford CT This financial, and additionally any money share from you, need to be no less than 80% of your own complete price. The most complete cost was ?600,000.