A great 401(k) retirement package is actually a powerful unit for building debt coming. Given by many companies in america, it allows you to definitely rescue to own retirement through contributions truly from your paycheck just before taxes are determined. So it lowers your taxable earnings, and your money increases tax-deferred into the membership. Ideally, a beneficial 401(k) is meant to give income using your advancing years many years.

Yet not, life is place unanticipated curveballs. Particular 401(k) preparations offer the choice to borrow against your conserved loans. This is appealing when confronted with emergencies or big expenses particularly medical costs, household repairs, if not an advance payment to your a house.

It’s crucial to understand that borrowing from the bank from your own 401(k) might be contacted which have care. View it as the a history hotel, not a handy means to fix take more cash. If you are you will find benefits to 401(k) loans, it’s vital knowing the potential disadvantages and just how they could apply to your own long-title economic safeguards.

How come an excellent 401(k) Mortgage Really works?

- Eligibility: Begin by centering on that not all of the 401k preparations ensure it is financing. It is required to look at the particular plan’s statutes together with your officer or Hour agency.

- Financing Limits: Identify there are restrictions on borrowing from the bank count. Usually, you could borrow around fifty% of your own vested balance (new part one to completely falls under your) or $fifty,000, any sort of was reduced.

- Rates: Declare that when you’re 401(k) financing rates are very different because of the bundle, these include fundamentally competitive with unsecured loans. An important huge difference would be the fact you are basically paying interest so you can on your own, just like the that cash dates back into your senior years membership.

- Fees Terms: Very preparations need you to pay off the borrowed funds contained in this five years. Payroll deductions may be the common payment strategy, making sure constant and you can automatic advances.

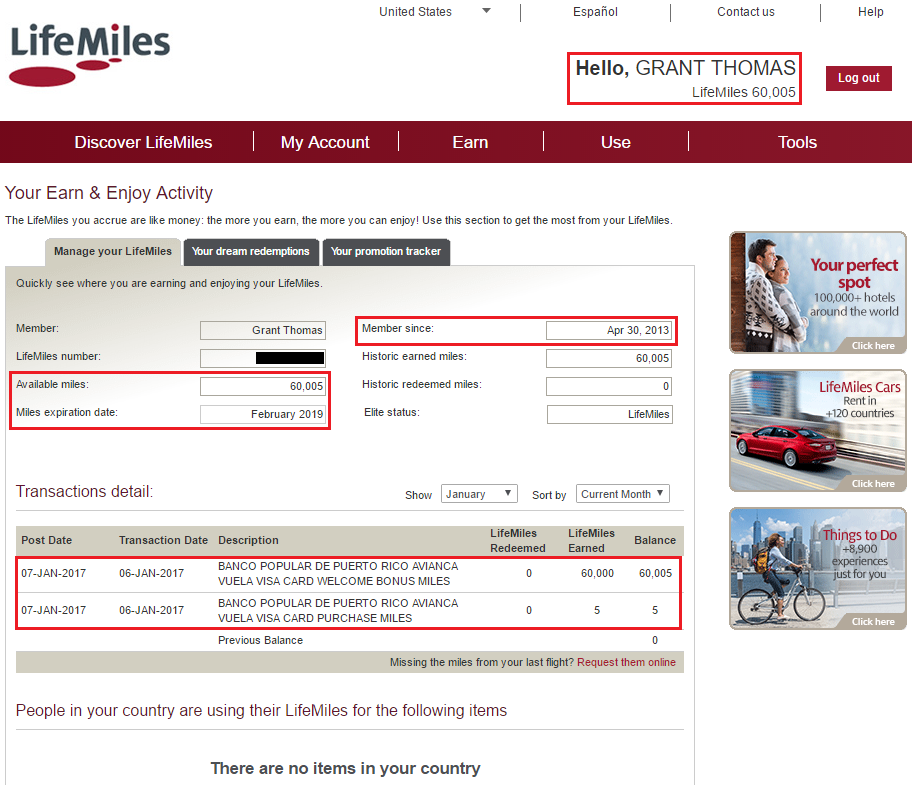

Example: Imagine the vested 401(k) equilibrium is $sixty,000. You could obtain around $30,000 (50%). You’ll after that repay that it, plus appeal, more a great five-year period using write-offs from your own paychecks.

Benefits associated with an excellent 401k Loan

- Accessibility: In place of antique loans from banks, being qualified getting an effective 401(k) mortgage is relatively simple. There is absolutely no credit check in it, because you might be essentially credit from the currency.

- Down Attract: Normally, the interest cost on 401(k) loans try somewhat less than unsecured loans otherwise bank card pricing. This can bring about nice offers along side life of the latest loan.

- No Borrowing Impression: As the 401(k) money are not reported to help you credit bureaus, they don’t affect your credit rating. This is certainly particularly beneficial if you are intending and come up with a major pick, including property, in the future.

- Convenience: This new fees processes can be sleek courtesy automatic payroll deductions. Which does away with troubles from a lot more debts and ensures uniform fees improvements.

Note: It is worth highlighting you to definitely because the attention you pay goes back in the 401(k), there can be however the opportunity cost of lacking potential market progress at the time those funds is out of your account.

Dangers of 401(k) Fund

- Smaller Senior years Savings: This can be arguably the greatest exposure. When you use from your 401(k), your miss out on the efficacy of substance desire. The bucks withdrawn no longer is working out for you, possibly causing an inferior nest-egg into the old-age.

Example: Suppose you’re taking an excellent $ten,000 401(k) financing and lose out on an average eight% annual return more than 5 years. You possibly overlook over $4,000 during the progress you would features or even had.

When does a great 401k Loan Make sense?

In spite of the dangers, there are specific times when a 401(k) loan might possibly be a reasonable solution to an economic issue. Here is a table so you can instruct potential conditions, and notes to consider:

Simply consider this in the event the 401(k) loan rate of interest is significantly below the interest on the existing debt; otherwise, the risks to your old-age more than likely provide more benefits than the huge benefits.

Note: Inside these circumstances, a great 401(k) loan is going to be a thoroughly experienced decision. It is essentially advisable to mention choice basic, such strengthening an emergency financing.

Selection so you can 401k Fund

Note: It certainly is wise to compare the real can cost you each and every option, including rates, cost timelines, and you will potential affect their long-label financial desires, before making a decision when the a great 401(k) financing ‘s the proper possibilities.

Conclusion

Borrowing from the 401(k) will be a viable choice for true problems or extreme expenditures eg property. The reduced interest levels and you can smooth installment is actually masters. Yet not, it’s important to keep in mind this is simply not free money. The impact on pension deals should be carefully believed, together with possibility fees and you may punishment for many who leave your job. Usually weighing the dangers very carefully ahead of tapping into pension finance. Talking to a monetary elite group makes it possible to mention all of your current alternatives to make a knowledgeable decision for the monetary coming.

Note: All the information given was sourced from individuals other sites and obtained studies; in the event that discrepancies are proceed the link right now known, please contact united states as a consequence of comments for prompt correction.