https://speedycashloan.net/loans/400-dollar-payday-loan

This type of people are likely become borrowing-limited and have low income

- Percent out-of complete domestic really worth removed inside first year: 6%

- Percent regarding equity removed invested into the first 12 months: 47%

- 3% from household security invested within the first 12 months.

These types of home owners are most likely becoming borrowing-restricted and have lower income

- % off total family well worth removed during the first year: 15%

- Percent out-of equity extracted spent inside the first year: 33%

- 5% out-of home collateral spent into the first 12 months.

In the current interest environment, refinancing specifically you are going to bring exchangeability owing to straight down monthly obligations and you will/or a huge infusion of cash

For both cash-away refinances and you can HELOCs, people who have higher mutual financing-to-really worth (CLTV) ratios-that were nearer to limitations usually necessary for lenders-and more youthful homeowners spent the largest tiny fraction of your own guarantee you to definitely is actually extracted.

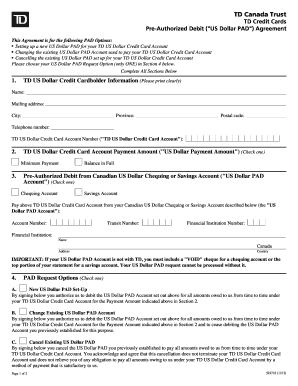

Range and pub chart showing per cent from household value liquidated and you will % out of security extracted invested in one 12 months from the mutual LTV. Listed below are estimate proportions. The brand new HELOC (guarantee extracted because % regarding family really worth) bar chart reveals equivalent pattern out-of only below 10% around the all the shared LTV teams. The cash-aside re-finance (guarantee removed due to the fact % away from household really worth) bar chart reveals hook upward trend, about thirteen% during the

All of our abilities recommend that principles facilitating entry to domestic equity detachment could have extreme macroeconomic outcomes just like the application reaction to that it liquidity at home guarantee is high.

Therefore, deleting frictions and you can traps to help you house guarantee withdrawal manage improve indication away from economic rules toward genuine cost savings through both the construction wide range feeling station (since the guarantee extraction ‘s the procedure one links domestic rates like to help you increased application) and the refinancing station (due to the fact purchasing reaction to extra cash on give goes with the fresh response to down monthly premiums).

High barriers possess remaining security withdrawal craft lower just like the Great Credit crunch, plus also have and you may demand activities (see talk within the Farrell mais aussi al. 2020) and you can really-recorded frictions so you can refinancing. The modern low levels from collateral extraction pastime compared to historically high account ensures that when the any of these barriers was removed to support higher collateral detachment, there may be higher macroeconomic consequences towards the application. In reality, Black colored Knight rates you to at the time of the initial quarter out-of 2020, discover $6.5 trillion regarding household equity that is available is liquidated certainly one of homeowners which have a mortgage.

The capacity to liquidate wide range regarding a person’s home can be especially essential property owners whether they have good domestic collateral however, face economic uncertainty, as well as happening during the COVID-19-induced credit crunch. Property try sitting on over the years large quantities regarding family guarantee and you may, in contrast to the favorable Credit crunch, have not seen their residence equity ranks erode at this point. Because of the dependence on cash flow dynamics and you will exchangeability having use and you may existence newest for the obligations money, proceeded use of family security can play a crucial role in the permitting homeowners climate financial downturns by providing required exchangeability. However, some great benefits of liquidating house guarantee should be healthy up against maintaining in charge financing means, increasingly difficult during the an uncertain economic climate.

Understanding the inherent intricacies the non-public markets confronts into the maintaining availability to domestic collateral withdrawal to have property owners, the general public field may prefer to envision authorities-supported selection that allow home owners to gain access to the brand new illiquid wide range into the their homes if the sense earnings interruption to prevent even more costly influences to group or the full mortgage field. A federally protected household security tool otherwise system similar to the Family Affordable Re-finance Program (HARP) then followed adopting the casing s could help a whole lot more residents that would take advantage of refinancing do very.