If you’ve ever looked at to invest in property, it’s possible this of the things blocking you from and then make the plunge is the down payment. And that means you might be curious: Could there be an effective way to rating a zero-off financial?

The fresh new brief answer is, Possibly. New expanded answer is, It is difficult. And also the longest answer is, It will be it is possible to, but it is more than likely perhaps not your very best solutions.

If you want to understand advantages and you can drawbacks of purchasing property without advance payment read on.

0% off financial choices

You should keep in mind that if you’re looking for a no-currency down mortgage solution, the probabilities are restricted. The most popular funds is actually:

U.S. Institution from Experts Items (VA): So you’re able to be eligible for this loan, you need to be a seasoned. Be sure to possess a good credit score, a constant income and you may Certification out-of Qualifications throughout the Va. not, even if you meet most of these standards, you may still are obligated to pay a down payment in the event the profit price of the house exceeds the appraised worthy of.

All of us Institution away from Agriculture (USDA): That it mortgage was designed to help lowest-and you may middle-money individuals end up being residents. But not, referring with many different official certification, also measurements of the home (smaller compared to step 1,800 ft) and you can venue (rural).

otherwise Piggyback money: Sometimes, you may be capable of getting a couple finance, that having 80% of the can cost you therefore the most other getting 20% of one’s costs, towards the 20% mortgage costing increased interest.

Your ily user to discover the loan need. not, its recommended that you really have a written agreement of percentage arrangement.

Since you’re always the preferred the way to get a zero-off mortgage, let us discuss the gurus plus the drawbacks.

The huge benefits

- You really have constant a career and good credit but are unable to conserve enough money to possess a down payment.

- Stepping into your own house will get you out of an unhealthy way of life disease.

The downsides

While you are to order a property with no downpayment can make you a resident, there are certain potential economic cons you will need to consider:

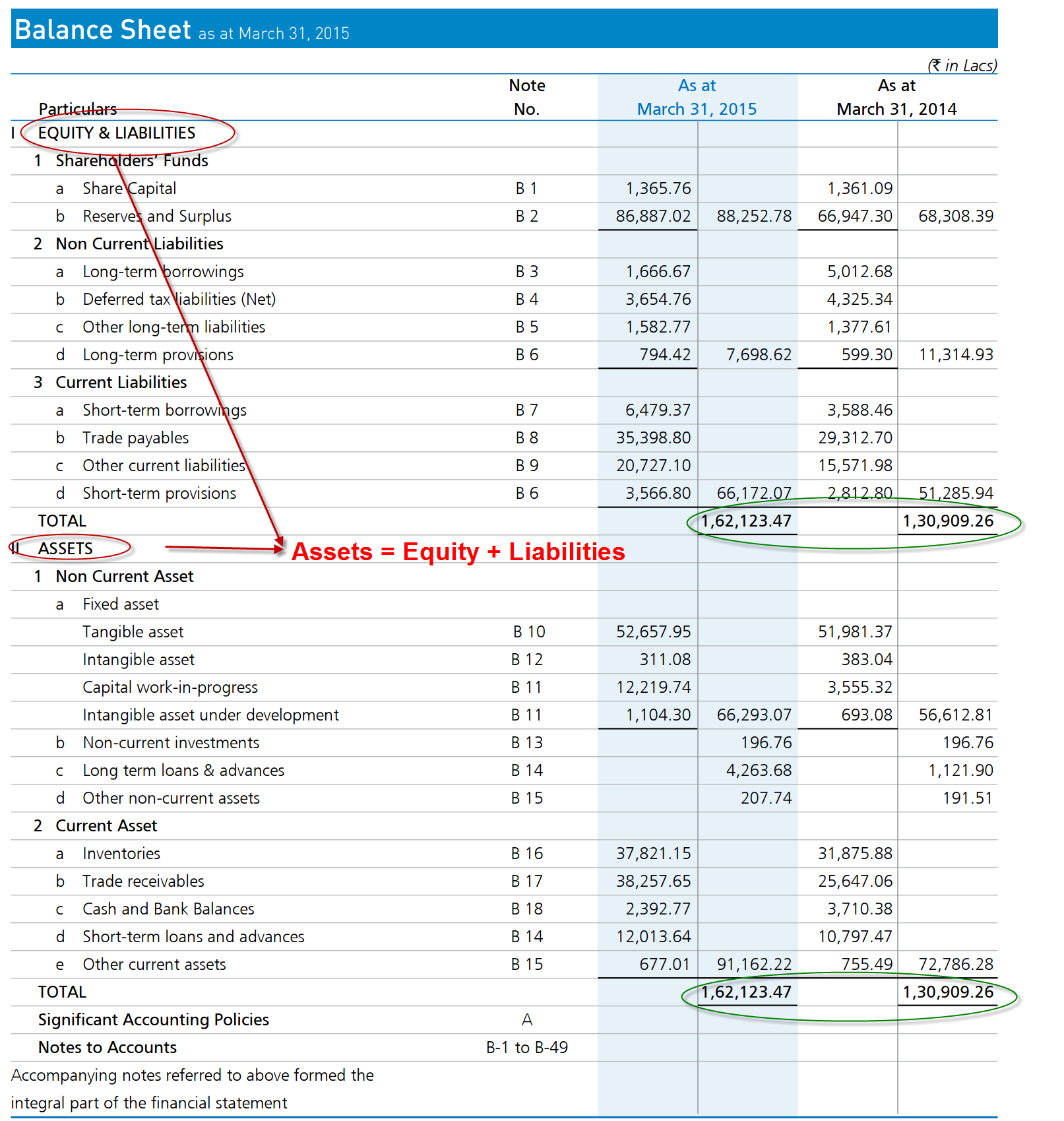

You will likely have a higher interest

Lacking any kind of savings may indicate so you’re able to possible loan providers that you’re from the a higher danger of foreclosures. So, while they may give your financing, it’ll be at the a higher interest. This may significantly increase the matter you have to pay throughout the years.

Such as, an enthusiastic $80,000 mortgage having an effective 4% interest can be costing $137,496 over three decades, when you’re good 5% interest will cost $154,605

You’ll pay more attention even with a lower life expectancy speed

The greater the loan, the greater possible shell out in the focus. Which have a deposit away from simply 3.5%, the cost of their $80,100000 loan during the cuatro% notice drops in order to $.

That you may have to take PMI

If for example the financing wide variety to more than 80% of the cost of your house, you have got to take out Individual Home loan Insurance policies (PMI) to safeguard the firm giving you the mortgage. This enhances the price of your month-to-month financing repayments.

You might be prone to finish under water

After you are obligated to pay on your home, you happen to be on a top risk of are underwater-which is, due extra cash than you reside well worth. With the cost savings inside the flux, the potential for delivering under water grows.

Thought another option

Regardless of if a no-down mortgage is capable of turning you on a resident, it will more than likely charge you https://www.elitecashadvance.com/installment-loans-md/long-beach/ several thousand dollars a whole lot more during the the future. As an alternative, think taking a loan due to Higher Alliance’s Domestic Able System. Apps such as this is:

- Let you buy a home that have only a beneficial step three% deposit

- Place you in touch with possible deposit recommendations software

- Reduce your mortgage insurance requirement

- Enables you to be eligible for a lower rate of interest

Speak home loan choice

If the a zero-down financial isn’t for your requirements, we are right here to share reduced-prices or basic-day family customer apps. Link right now to plan a