A mortgage as you are able to be able to pay is much more probably be recognized for you whether your underwriting are sound. So you’re able to understand how your loan application might possibly be examined, i enter into subsequent outline on what underwriting was and how it functions.

What exactly is Mortgage Underwriting?

Underwriting are a procedure through which a lending company assesses the brand new likelihood of credit money with the loan. Before you choose whether or not to accept the financial application, the lending company, borrowing from the bank relationship, or lender performs underwriting to evaluate your own odds of having the ability to repay the borrowed funds.

The number of records necessary for your application is actually gathered by the an effective mortgage manager otherwise mortgage broker just before underwriting. The next step to own a keen underwriter is to show your own name, lookup your credit report, and you may evaluate your financial updates, including your money, cash on give, investments, financial possessions, or any other exposure affairs.

The borrowed funds Underwriting Process

This new underwriting procedure usually takes a while. No matter if each bank has somewhat various other measures and you will methodologies, another five steps mainly make-up the newest underwriting processes:

- Pre Recognition

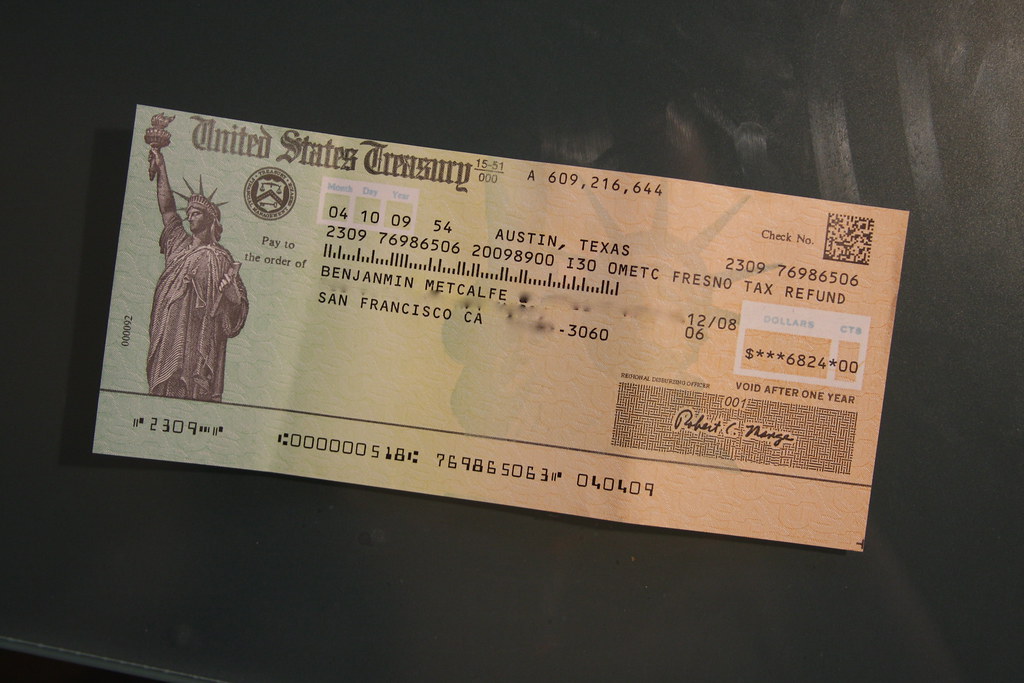

- Earnings and you will resource verification

- Assessment

- Label look and you will insurance

- And also make a credit choice

step 1. Bringing preapproved

Score pre-recognized to possess a home loan as your earliest step, before you even begin looking having property. A loan provider have a tendency to examine your economic information, as well as your earnings and you may expenses, and also the result of a credit check, to determine whether you are preapproved.

Understand that acquiring prequalification and receiving preapproval are a couple of distinctive line of process. While your financial condition doesn’t transform, pre-approval out-of a loan provider basically setting you will be subscribed to own a put quantity of money.

To phrase it differently, good prequalification is actually an indication that you may possibly getting acknowledged getting a loan. Compared to a prequalification, bringing pre acceptance normally means that supply the bank way more guidance.

2. Money and investment verification

Be ready to promote next economic facts, such tax statements and you may savings account comments, in order to have your money validated. Assets that’s taken into account is money into your bank account, later years coupons, capital profile, the bucks property value your lifetime insurance policies, and you loans Forkland may ownership appeal when you look at the enterprises in which you features possessions throughout the variety of stock otherwise advancing years profile.

If the application is acknowledged, the financial will send you good preapproval letter detailing the willingness in order to give you money to a quantity predicated on the information you recorded. An effective preapproval page tells the seller that you’re an excellent major customer and have the financial resources to support a purchase promote.

3. Assessment

After you have put an offer to your a home that you instance that will be in your price range, a loan provider commonly appraise the house. This will be to choose perhaps the sum you available to pay makes sense as a result of the property’s reputation and therefore out-of close properties within the an equivalent budget. According to the proportions and you will complexity of the house, the expense of a property comparison varies from possessions so you can possessions.

4. Identity browse and you may label insurance coverage

A lender wouldn’t render money having a property who’s got courtroom states inside. To ensure the property can be transported, a title organization performs a title lookup.

To find mortgages, says, liens, easement rights, zoning statutes, most recent litigation, outstanding taxes, and you can limiting covenants, the term business commonly run reputation for the property. Following, the new title insurance carrier issues an agenda you to definitely ensures the validity of the data. A couple of policies may from time to time become issued: you to definitely protect the lending company (almost always needed) and another to safeguard the dog owner (recommended but could feel worthy of delivering).