It is impossible to be considered to have a good Virtual assistant financial for folks who haven’t actively served regarding U

Va lenders are interesting because they do not were plenty of different invisible fees. Nonetheless, you will find several that you should look for to get the best tip possible on which your really can pay for. Such costs become:

- Solutions — When obtaining a great Virtual assistant mortgage, new Virtual assistant features its own review and you will comparison complete on possessions that you’d like to acquire. To help you be considered, the home need to complement during the certain requirements as reported by the newest Va. Even in the event it’s not poorly common, sometimes the fresh Virtual assistant needs solutions and other work to performed earlier often agree financing. Owner is not permitted to make the repairs; its solely the duty of the customer. Such as this, you might happen a little extra costs of trying so you can safer a beneficial Virtual assistant home loan. For the most part, instance expenditures was restricted.

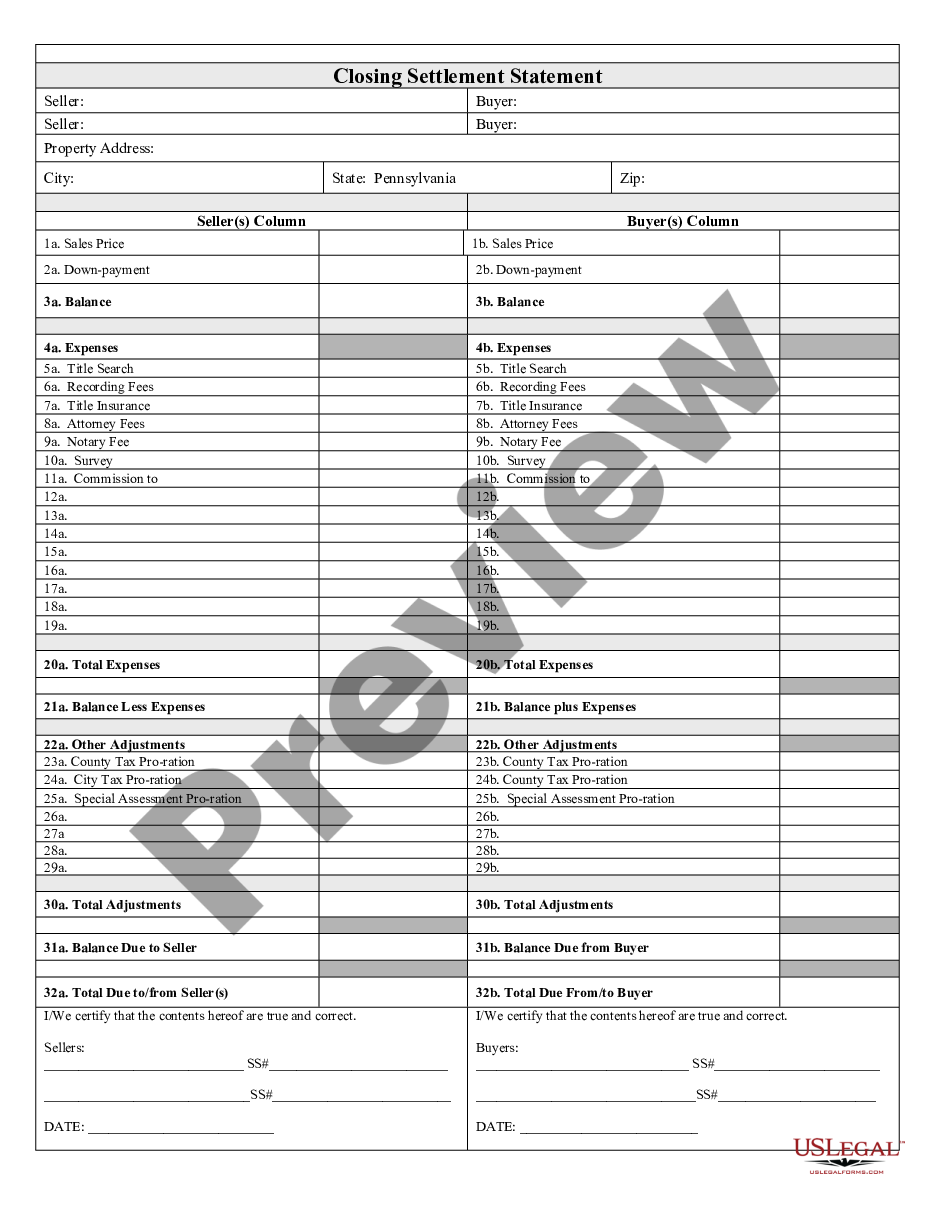

- Settlement costs — There are specific costs and expenses that the vendor try not to pay whenever a great Virtual assistant mortgage has been accustomed get a beneficial family. For instance, courier fees and you may file tape prices are usually the obligations away from the customer. Although they aren’t constantly poorly costly, they need to be taken into account whenever calculating simply how much you can afford to expend. And additionally, various Va financing charge can be your responsibility, as well as the expense of termite inspections — if they are called for.

- Financial support Charges — Off money are not necessary for Va lenders. not, if you make a down-payment with a minimum of 5% of your Alberta installment loans purchase price, you might avoid financing costs. Resource charges are essential by-law to own Virtual assistant mortgage brokers. Just in case you make zero downpayment at all, the fresh new money fee are going to be up to 2.15%. It ought to be listed, even in the event, that the payment is rolled for the complete loan and is not due upfront. Oftentimes, resource charges is generally waived. Experts who are getting Va compensation getting services-relevant handicaps, including, may not have to invest these charges. But not, you should intend on spending them and should include him or her into the your own data when attending pick a home through the Virtual assistant home loan program.

* The higher next play with percentage doesn’t apply at these kinds away from finance in case your Veteran’s merely earlier entry to entitlement are for a manufactured home loan.

As identity means, the fresh new Va mortgage system are set aside for pros and you will productive members of the united states armed forces. To help you meet the requirements, then, you otherwise your wife need either supported about several many years of energetic obligations into the Us army, otherwise need certainly to currently become signed up. The entire extent of your own You.S. armed forces is roofed about program, which means people in the You.S. Military, Navy, Marine Corps, Air Force and Coast-guard are typical qualified to receive this choice.

S. army. Even though you has actually served, in the event it was for under 24 months then you are perhaps not probably be considered. During attacks off conflict, productive personnel must have served for around 3 months so you’re able to meet the requirements. Including, when you find yourself not enrolled, the discharge shall be for any reason aside from dishonorable into the acquisition to help you be considered. So long as each one of these standards is actually fulfilled, you have no problem securing a beneficial Virtual assistant home loan.

Actions In order to Getting A good Va Home loan

Obtaining a Va home loan relates to a comparatively easy, simple process. Prior to going ahead on it, even when, you should become familiar with what you’re probably going to be asked accomplish. Lower than, the fundamental strategies to have getting an effective Va mortgage was detail by detail for your benefit. Although everybody’s experience is about to differ some, you can expect yours commit for the about next purchase: