Subtract the value of any increases in operating assets such as accounts receivable and monies owed to the business or add the value if operating assets have decreased. To give your accounting team a bit of guidance culled from our vast experience, Embark has prepared a Cash Flow Worksheet Template to make your own. No, our example is not meant for you to download and plug into your accounting process. We won’t be so bold to say cash flow worksheets are like snowflakes or a ten-minute drum solo, but we probably don’t have to.

What is a Google Sheets Cash Flow Template?

When you leave a comment on this article, please note that if approved, it will be publicly available and visible at the bottom of the article on this blog. For more information on how Sage uses and looks after your personal data and the data protection rights you have, please read our Privacy Policy. This guide covers basic manufacturing accounting terms you should know and what to look for when choosing an accounting software. The buying and selling of investments such as IP rights or contracts and the collection and issuance of loans from the business to subsidiaries of the company. Operating activities refer to the company’s primary revenue-producing activities. Instead of choosing from several different starting points, companies will be required to use the operating profit or loss subtotal.

Rise above the spreadsheet chaos

Enter year-by-year operations, investing activities, and financing details to see your year-over-year net increases or decreases. You can save this template as an individual file with customized entries, or share it with other business units or departments that need to provide cash flow details. A cash flow statement — which is also called a statement of cash flows — is used alongside a company balance sheet and income statement to review the financial performance of a business. These 3 key financial statements are used by investors and business owners to manage and improve the profitability of their business. The indirect method can be used to create the statement of cash flows from the information in the balance sheet and income statement, but I’ll leave that explanation for the textbooks. To create a cash flow statement manually, select a time period and review your income and expenses in each of the three activities discussed above.

Firm of the Future

With this balance sheet template, you can assess the financial standing of a business by examining assets, liabilities, and equity. Business owners can use it to evaluate performance and communicate with investors. Although there are some really cool things that can be done with Excel to make this worksheet more useful, I have intentionally kept this template simple.

A Couple Tips for Entering Amounts

Tally all cash inflows and outflows from fundraising and repaying debts that allow the company to operate or grow. Tally all cash inflows and outflows related to buying and selling property and assets that increase the value of the business. Along with the balance sheet and income statement, this set of financial documents are required for both private and public companies.

Calculate the total change by adding together the operating, investing, and financing activities. A standard format cash flow statement uses three main categories to show cash flows in and out of the business. Be vigilant, organized, and tailor your worksheet to your specific needs to maintain an accurate, insightful pulse on your cash flows that guides better decision-making.

“Expenses“ is an extensive category that captures not just your restaurant’s operational expenses but also marketing, subscriptions, travel, equipment, payroll, general, and research & development expenses. The template allows you to examine your finances in detail, with fields for specific items such as auto maintenance, child care, eating out, groceries, and more. Bank reconciliation is a crucial financial process for businesses to ensure that records match… However, these templates offer relatively basic functions and require a lot of back-end work in order to organize your financial information. The Vertex42 Template Gallery for Sheets add-on has a variety of professionally designed documents and spreadsheets ready to be used. The Tiller spreadsheet add-on is relatively advanced and is a more suitable option for people with experience in finances.

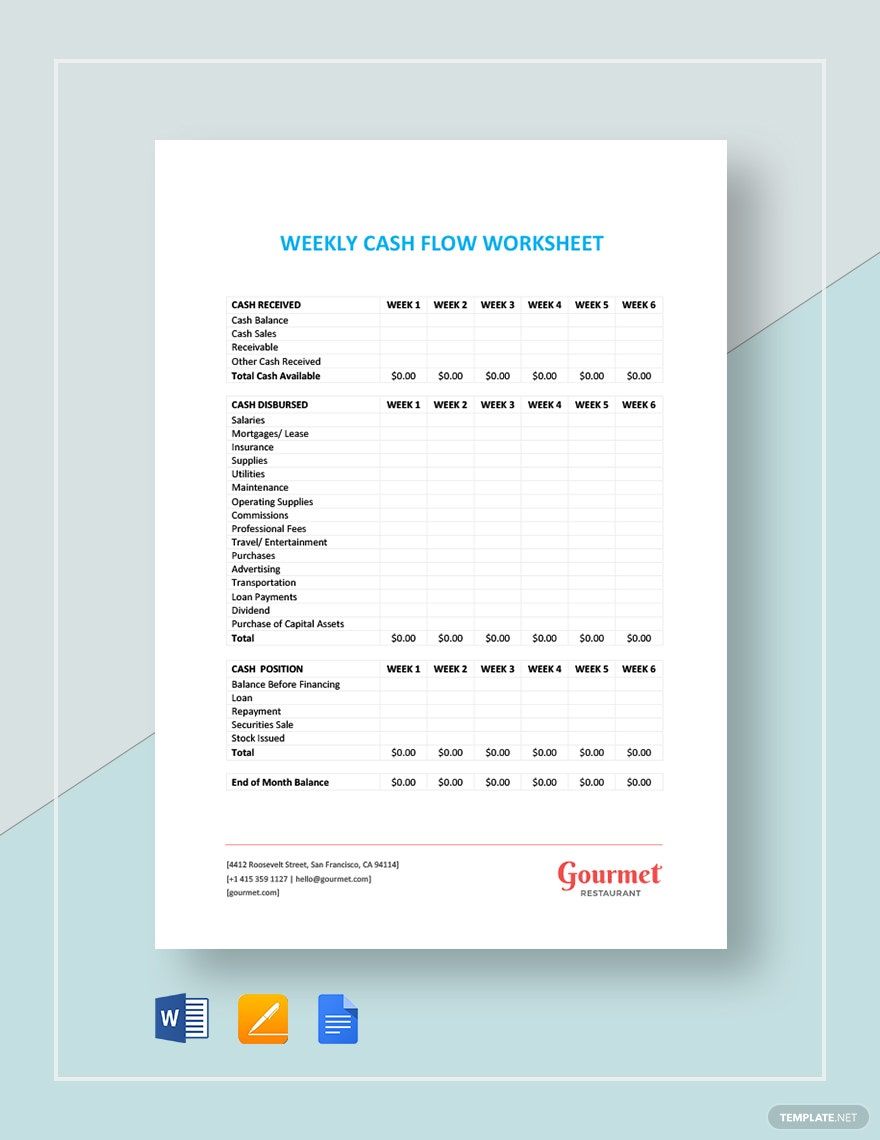

You get a snapshot of cash flows over a 12-month period in a basic Excel template. The Weekly Cash Flow Template is a powerful tool designed to help you track and analyze your cash inflows and outflows on a weekly basis. Whether you’re a business owner or an individual, managing your cash flow is essential for maintaining financial stability. This Free Downloadable Cash Flow Template, designed by Thomas Plaizier, is a valuable tool for small business owners who want to keep track of their cash flow efficiently.

- The net income line items are also adjusted for changes in the ending and starting balances of current assets (with the exception of cash).

- It helps you calculate your total cash upfront and the gross monthly rent you could earn from your property.

- Visualize key performance metrics with graphs and ensure your company stays financially ahead.

Examples of disbursements under the direct method include cash paid to suppliers for goods, cash paid to employees for services, and cash paid to creditors for interest and tax payments. Use this basic template to gain monthly insight into your company’s cash flow and ensure you have sufficient funds to continue operating. Fill in your information for beginning balance (cash on hand), cash receipts and disbursements (R&D), operating expenses, and additional expenses.

The personal cash flow template is a very simple and straightforward template to use to manage your household budget. If you have a hard time with this or simply don’t have the time, then no worry. This template accounts receivable template lists customers, invoice tracking details, amounts due, and outstanding balances. Keeping track of these accounts can inform your collections process by helping you quickly identify which overdue payments have aged significantly. You’d also need to fix the formulas in the summary rows at the top of the worksheet (copy the formulas used for the 2nd column to the right).

That means it’s important to effectively track everything flowing in and out of your accounts. There are tried and tested ways to achieve this, read on to discover the top 6 best cash flow templates. As two of the three main types of financial statements, both cash flow and income statements offer insight into a company’s financial performance. Download our cash flow template for Excel and read about how february holidays 2022 to prepare a cash flow statement and the differences between direct and indirect method. Income or expenses in foreign currencies can easily skew your cash flow worksheet with exchange rates that you fail to account for properly. When inflows or outflows differ from your reporting/functional currency, accurate cash flows quickly get lost in translation or, more accurately, lost in a lack of translation.